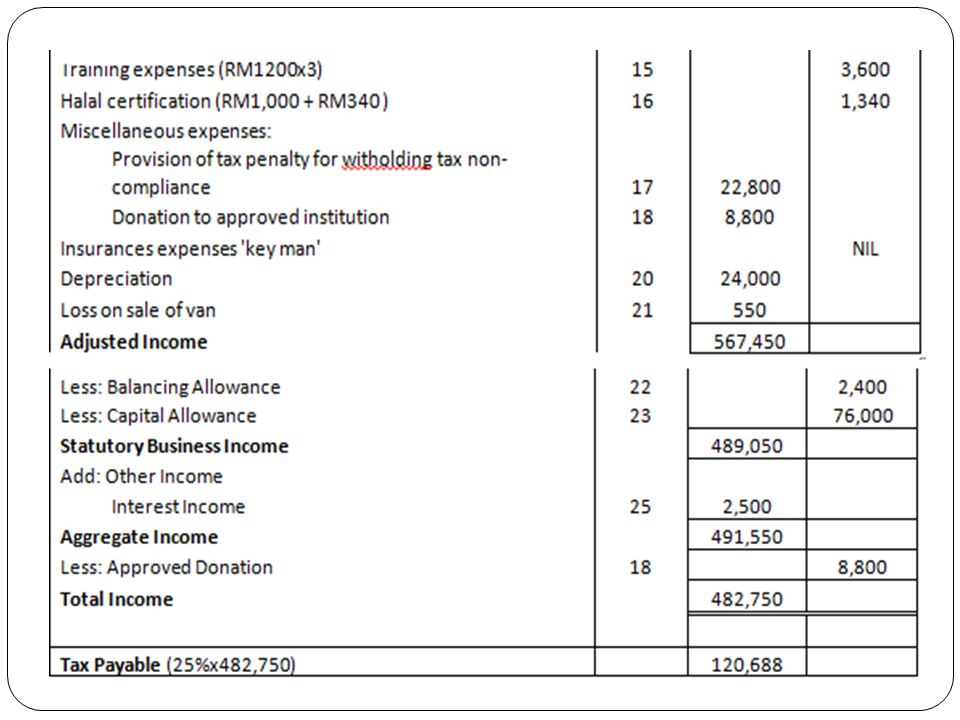

company tax computation format malaysia 2017

The EIS is governed under. The Finance Act 1999 ushered in the concept of slump sale by inserting section 242C and section 50B to the Income Tax Act 1961.

Payroll Specialist Resume Examples Created By Pros Myperfectresume

S r i ˈ l æ ŋ k ə ʃ r iː- US.

. Tax Treatment of Research And Development Expenditure Part II - Special Deductions. Orangutans are great apes native to the rainforests of Indonesia and MalaysiaThey are now found only in parts of Borneo and Sumatra but during the Pleistocene they ranged throughout Southeast Asia and South ChinaClassified in the genus Pongo orangutans were originally considered to be one speciesFrom 1996 they were divided into two species. Core HCM capabilities in the localized version of SAP ERP 60 for Malaysia support global business best practices.

To avail tax and regulatory advantages associated with it. Of Gujarat directs undertaking of partial audit assessment us 92 of Central Sales Tax Act 1956 rw Section 34 of Gujarat VAT Act for FY. Mobirise is a totally free mobile-friendly Web Builder that permits every customer without HTMLCSS skills to create a stunning site in no longer than a few minutes.

However such GST paid is also allowed as Input tax credit in same month and therefore net liability of tax will not increase. Article 9 OECD Model Tax Convention On Income and On Capital - OECD defines related companies as. Example A trader who is registered in GST takes services of Goods Transport Agency GTA for Rs.

The aim of the exam its structure and format. SBA received one set of comments regarding the SBIC. Browse our listings to find jobs in Germany for expats including jobs for English speakers or those in your native language.

A fuzzy concept is a kind of concept of which the boundaries of application can vary considerably according to context or conditions instead of being fixed once and for all. Double tax agreements Relevant to ATX-MYS. A 2011 study found that half of all American Jews have doubts about the existence of God compared to 1015 of other American religious groups.

Taxation of Partnerships Part II - Computation And Allocation of Income. The Graduate Aptitude Test in Engineering GATE is an examination conducted in India that primarily tests the comprehensive understanding of various undergraduate subjects in engineering and science for admission into the Masters Program and Job in Public Sector CompaniesGATE is conducted jointly by the Indian Institute of Science and seven Indian. For Professional Tax computation new slabs and corresponding deduction amounts are introduced by the Punjab Government.

All our papers are written from scratch thus producing 100. 6 to 30 characters long. As a company we try as much as possible to ensure all orders are plagiarism free.

FREE formatting APA MLA Harvard ChicagoTurabian 24x7 support. A beneficial owner of 20 or more of the ordinary share capital of the company. Read this in-depth article to know all about Malaysia payroll including levies contributions taxes.

Formerly known as Ceylon and officially the Democratic Socialist Republic of Sri Lanka is an island country in South AsiaIt lies in the Indian Ocean southwest of. Malaysia payroll and tax has multiple components. Notification of Filing Obligation Each year IRAS will issue notification letters to the Reporting Entities on their obligation to file a CbC Report to IRAS for the preceding FY.

In October 2017 the CBDT introduced new rules Rule 10DA and Rule 10DB to the Income Tax Rules 1962 and new Forms were prescribed Form CEBA to Form 3CEBE. You may refer to the e-Tax Guide on Country-by-Country Reporting PDF 712KB for details on the report format and information to be submitted. Malaysia including an outline on what trusts are aspects of tax treatment of trusts and trust beneficiaries and tax computation of trusts.

It has a definite meaning which can be made more precise only. On October 13 2017 82 FR 47645 SBA extended the comment period. Must contain at least 4 different symbols.

Review your writers samples. Age identification of persons 65 years or older for processing tax claims and rebates February 2017. During 2017 Malta introduced a new NID regime which is effective from the 2018 year of assessment.

ASCII characters only characters found on a standard US keyboard. The Central Government has amended Section 37 Section 39 of Central Goods Service Tax Act CGST 2017 vide Notification No. This means the concept is vague in some way lacking a fixed precise meaning without however being unclear or meaningless altogether.

In April 2021 these Master File and CbCR rules were further relaxed by the CBDT through amendments to the Income Tax Rules which will be relevant to the assessment year AY. In the computation of duty on entries ad valorem rates shall be applied to the values in even dollars fractional parts of a dollar less than 50 cents being disregarded and 50 cents or more being considered as 1 with all merchandise in the same invoice subject to the same rate of duty to be treated as a unit. Taxation of Partnerships Part I - Determination of the.

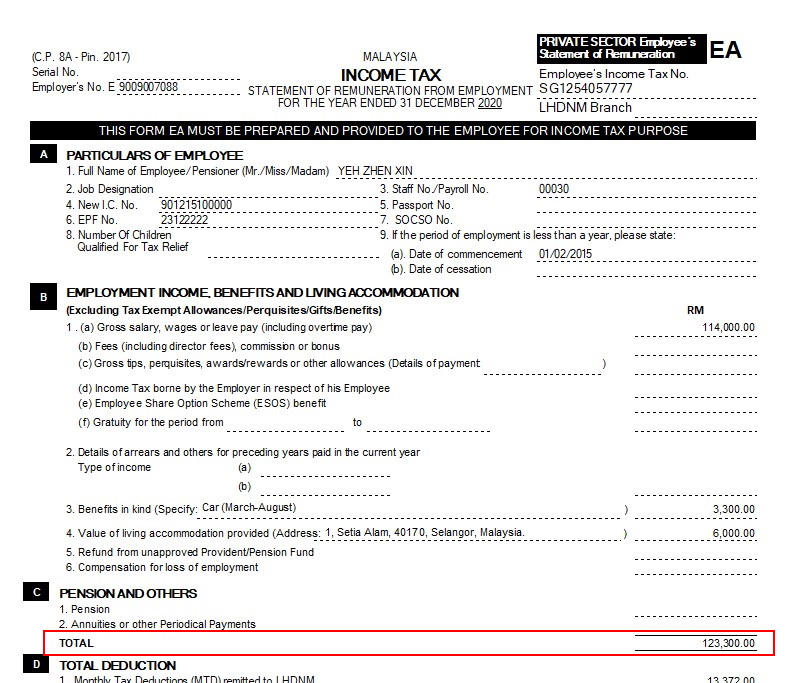

Import Tariff value of Gold increased from USD 55810 grams to USD 57010 grams and that of silver increased from USD 568 kilogram to USD 577 kilogram. The ways in which such a. The computation of VOLA will be the defined value of the living accommodation.

This page lists well-known Jewish atheistsBased on Jewish laws emphasis on matrilineal descent religiously conservative Orthodox Jewish authorities would accept an atheist born to a Jewish mother as fully Jewish. A national identification number national identity number or national insurance number or JMBGEMBG is used by the governments of many countries as a means of tracking their citizens permanent residents and temporary residents for the purposes of work taxation government benefits health care and other governmentally-related functions. The proforma can also be downloaded in Excel formatThe Checklist preparation of the corporation tax computation sets out a list of queries that may be helpful in gathering the information required to complete the computationTrading profitsThe calculation of trading profits and the adjustments that must be made for companies is dealt with.

Aerocity Escorts 9831443300 provides the best Escort Service in Aerocity. This determination of the sale price may be referred to as the transfer price. On August 15 2017 82 FR 38617 SBA published a request for information seeking input from the public on SBA regulations that should be repealed replaced or modified because they are obsolete unnecessary or burdensome.

182022Central Tax dated 28th September 2022 with effect. Tax Guru is a reliable source for latest Income Tax GST Company Law Related Information providing Solution to CA CS CMA Advocate MBA Taxpayers. -ˈ l ɑː ŋ k ə.

The selling price of a product charged by the parent company to the subsidiary company may differ from the selling price with an independent third party. While the former defined slump sale the later provided the mode of computation of tax on slump sale. This service is listed under the reverse charge list therefore trader has to pay tax 18 on Rs.

If you are looking for VIP Independnet Escorts in Aerocity and Call Girls at best price then call us.

Accounting Assistant Resume Sample Job Description Tips

Understanding Tax Smeinfo Portal

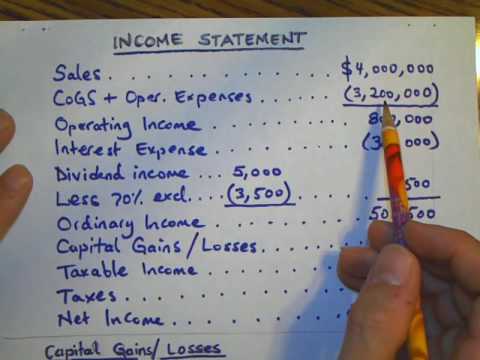

Lec 5 Corporate Income Tax Example 1 Youtube

Tax Senior Associate Resume Samples Velvet Jobs

Computation Format For Individual Tax Liability For The Year Of Assessment 20xx Docx Computation Format For Individual Tax Liability For The Year Of Course Hero

Malaysia Taxation Junior Diary Non Income Producing Dormant Inactive

Business Tax Deadline In 2022 For Small Businesses

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

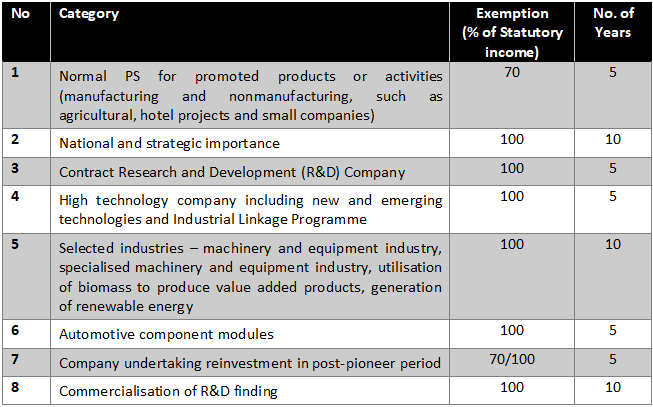

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Tax Computation Malaysia Fill Online Printable Fillable Blank Pdffiller

Chapter 5 Computation Of Statutory Business Income Latest Pdf Bad Debt Expense

Format For The Computation Of Business Income Tax 267 Business Income Format Format For The Studocu

Rpgt For Company In Malaysia L The Definitive Guide 2022 Industrial Malaysia

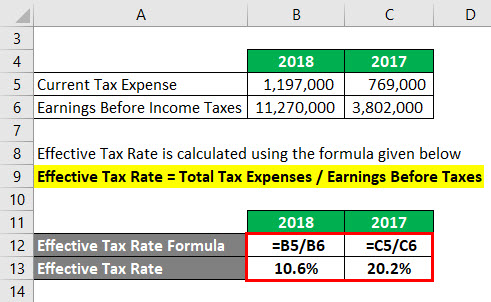

Effective Tax Rate Formula Calculator Excel Template

On The Radar Accounting For Income Taxes Deloitte Us

Format Computation 1 Xlsx Computation Of Chargeable Income Tax For Ya Xxxx Husband Wife S 4 A Business Income Adjusted Income Add Balancing Course Hero

New Irs Announces 2018 Tax Rates Standard Deductions Exemption Amounts And More

0 Response to "company tax computation format malaysia 2017"

Post a Comment